nh tax return calculator

While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. To calculate how much tax you need to pay use the Estimated Tax Worksheet which is part of Form 1040-ES.

Free Llc Tax Calculator How To File Llc Taxes Embroker

Estimate your federal income tax withholding.

. For Taxable periods ending on or after December. New Hampshire Income Tax Calculator 2021. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year.

New Hampshire income tax rate. 20222023 New Hampshire State State Tax Refund Calculator. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return.

Line 11 Enter payments previously made from an a application for. How It Works. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on.

0 5 tax on interest and dividends Median household income. The new hampshire state tax calculator nhs tax calculator uses the latest. The 2021 real estate tax rate for the Town of Stratham NH is.

Calculate your total tax due using the NH tax calculator update to include the 20222023 tax brackets. For transactions of 4000 or less the minimum tax of. See how your refund take-home pay or tax due are affected by withholding amount.

The New Hampshire statutes governing interest rates were amended in 1995 Chp. This tax is only paid on income from these sources that is 2400. The new hampshire state tax calculator nhs tax calculator uses the latest federal tax tables and state tax tables for 202223.

268 Laws of 1995 to require that starting on January 1 1998 and determined annually. If you have filed with New Hampshire Department of Revenue Administration after 1998 you can pay your Business Enterprise Tax BET and Business Profit. This calculator is for 2022 Tax Returns due in 2023.

E-File Help - Business Tax Help. Your average tax rate is 1198 and your. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Census Bureau Number of cities that have local income taxes. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

Use this tool to. Deduct the amount of. Line 10 The application will calculate the New Hampshire Interest and Dividends Tax and display the result.

Best Free Tax Software 2022 Free Online Tax Filing Zdnet

Hera S Income Tax School New Hampshire

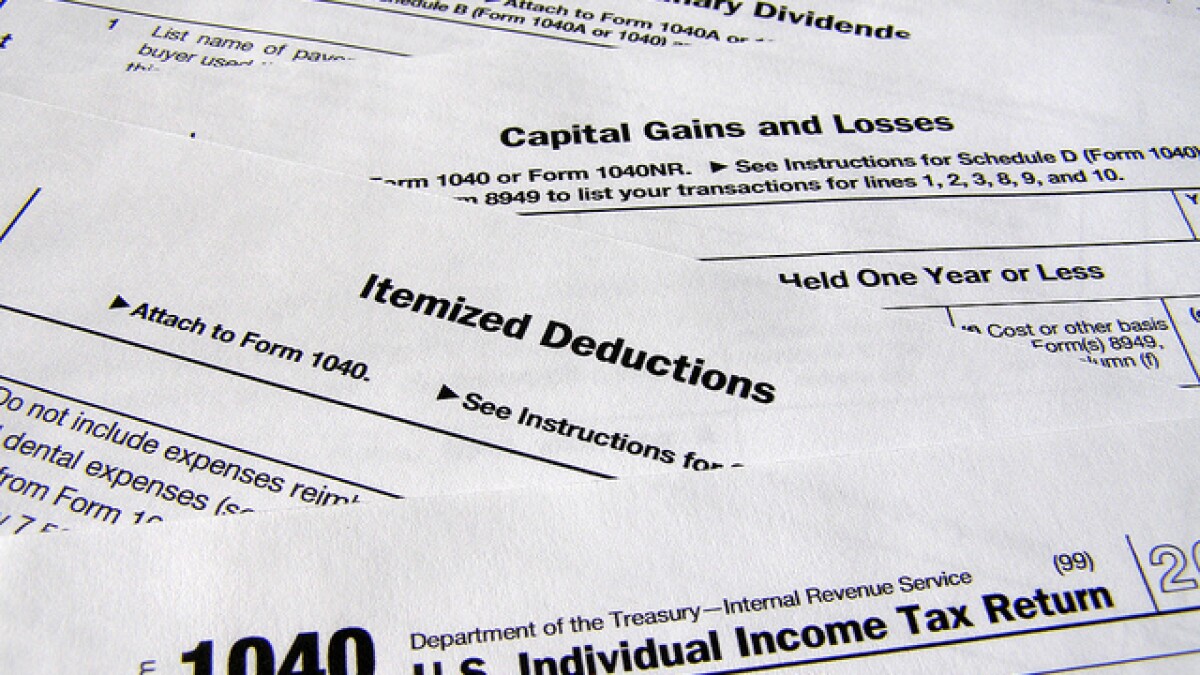

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

State Income Tax Treatment Of Health Savings Accounts Hsa Hsa For America

New Hampshire Form 2290 E File Highway Vehicle Use Tax Return

Nh Penalty On Form 2210 For 2020

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

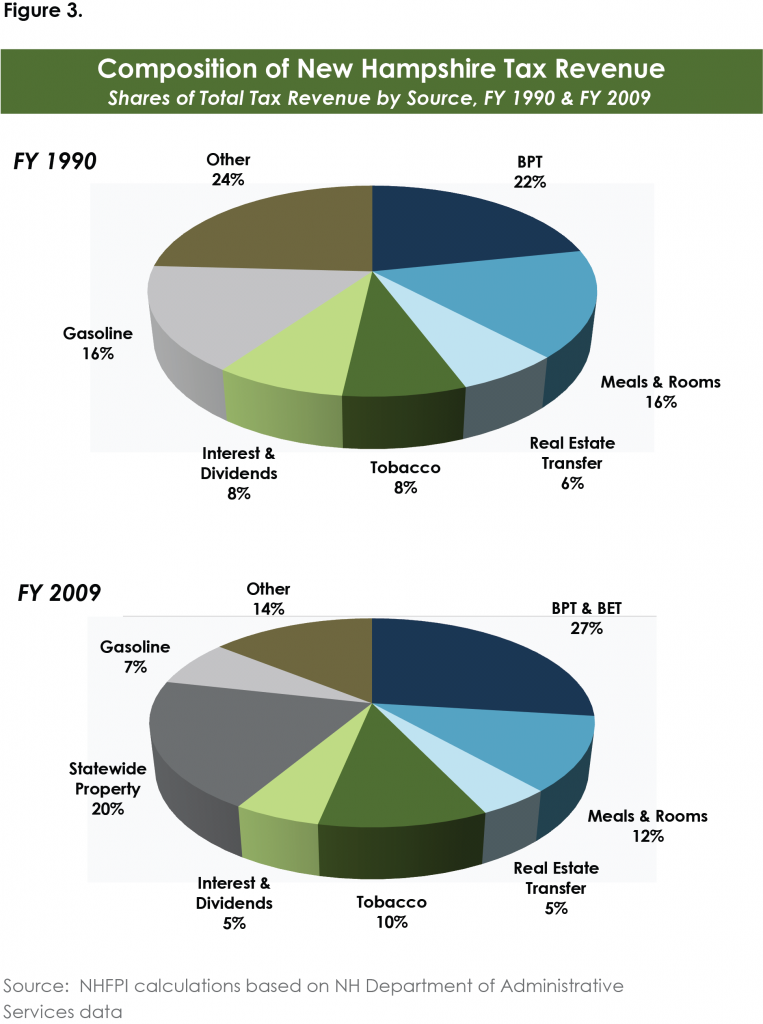

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

How To File Taxes For Free In 2022 Money

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Free Llc Tax Calculator How To File Llc Taxes Embroker

Tax Calculator Return Refund Estimator 2022 2023 H R Block

3 Things You Need To Know About The New Tax Code New Hampshire Public Radio